The latest business news as it happens

Article content

Today’s headlines

Advertisement 2

Article content

Article content

Top story

Loblaw to build more than 40 new stores in $2-billion expansion

Loblaw Cos. Ltd. says it will build more than 40 new stores as part of a record investment plan of more than $2 billion.

The parent company of Loblaws and Shoppers Drug Mart said it will also expand or relocate another 10 locations.

It will renovate more than 700 others.

Loblaw said the company’s capital investments this year are expected to create more than 7,500 jobs in Canada.

The company has a network of 2,500 stores across the country.

In addition to Loblaws and Shoppers Drug Mart, the company’s banners include No Frills, Real Canadian Superstore and T&T.

— The Canadian Press

4:40 p.m.

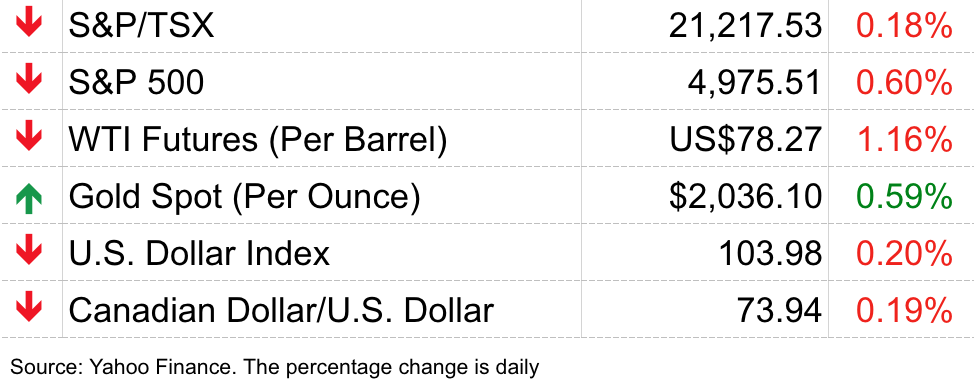

Market close: TSX down slightly, U.S. stock markets slide

Canada’s main stock index was down slightly and U.S. markets also fell, as investors continue to make guesses about when central banks on either side of the border will start cutting interest rates.

The S&P/TSX composite index was down 38.08 points at 21,217.53.

In New York, the Dow Jones industrial average was down 64.19 points at 38,563.80. The S&P 500 index was down 30.06 points at 4,975.51, while the Nasdaq composite was down 144.87 points at 15,630.78.

Advertisement 3

Article content

The Canadian dollar traded for 73.98 cents U.S. compared with 74.16 cents U.S. on Friday.

The April crude oil contract was down US$1.42 from Friday at US$77.04 per barrel, while the March natural gas contract was down three cents at US$1.58 per mmBTU.

The April gold contract was up US$15.70 from Friday at US$2,039.80 an ounce and the March copper contract was up three cents at US$3.87 a pound.

— The Canadian Press

3:18 p.m.

Ottawa offers up to $2 billion in financing for B.C. homebuilding

The Canadian government will provide up to $2 billion in low-cost financing to accelerate homebuilding for middle-income families in British Columbia, Prime Minister Justin Trudeau announced Tuesday.

The investment adds to the province’s commitment to provide $2 billion in loans and $950 million in spending as part of a program dubbed BC Builds, unveiled by Premier David Eby last week.

Trudeau said the federal financing will be available through the apartment construction loan program. Combined with the provincial investment, the loans will help build a minimum of 8,000 to 10,000 additional new homes for the middle class, he said.

Article content

Advertisement 4

Article content

The prime minister praised Eby for taking “concrete visionary action” with BC Builds.

“What you’re doing here is transformative and I am hoping that other provinces take careful note of the leadership that you’ve shown,” he said at a news conference alongside the premier in Vancouver.

— Bloomberg

2:31 p.m.

Ottawa reducing carbon tax rebates for small businesses

The federal government is cutting the amount of money small- and medium-sized businesses will be given from carbon tax revenues so it can increase the amount of money rebated to rural families.

That’s happening even as the government still owes businesses $2.5 billion in carbon tax revenues from the first five years of the program.

Dan Kelly, the president of the Canadian Federation of Independent Business, says businesses were already getting far less back from carbon taxing than they pay, and this will make that even worse.

The federal government says it intends to return $623 million in carbon tax revenues to businesses for the 2023-24 year.

That’s one-third less than was set aside for business rebates for the previous year, when the carbon tax itself was $15 less per tonne.

Advertisement 5

Article content

The carbon tax rebate programs for business are tied specifically to investments they make in energy efficiencies, but those programs have issued less than $100 million to businesses to date.

The federal government’s decision last fall to add another 10 per cent to household carbon rebates for rural Canadians reduced the amount of money left to distribute to business even further.

— The Canadian Press

1:14 p.m.

Brookfield explores new infrastructure fund months after record close

Brookfield Asset Management Ltd. is beginning early-stage discussions about its next infrastructure product, two months after it closed a record fund that it’s deploying into transportation, telecom and other hard assets.

The world’s second-largest alternative asset manager has started informal talks with investors for the sixth vintage of the flagship Brookfield Infrastructure Fund, aiming to launch next year, according to people familiar with the matter who asked not to be identified because the matter is private. The timing is subject to change, one person said.

Brookfield received US$30 billion in commitments for its infrastructure strategy in a process that closed in late 2023 — US$28 billion for the fund and US$2 billion for related co-investment vehicles. A representative for the firm declined to comment.

Advertisement 6

Article content

The Toronto-based manager has US$154 billion of fee-paying assets across its infrastructure, renewables and climate-transition businesses, accounting for one-third of the US$457 billion in capital from which it draws fees.

Brookfield’s infrastructure unit pitches the funds as a way for investors to play major trends shaping the global economy, including the clean-energy transition, digitization and artificial intelligence. Like rival Blackstone Inc., it has poured money into data centres to capitalize on growing interest in AI.

— Bloomberg

Noon

TSX seesaws, U.S. stocks fall

Canada’s main stock index seesawed between narrow gains and losses on Tuesday, while U.S. stocks were lower after markets in both countries were closed Monday for a holiday.

The S&P/TSX composite index was down 0.03 per cent at 21,248.45.

In New York, the Dow Jones industrial average was down 0.36 per cent at 38,485.80. The S&P 500 index was down 0.64 per cent at 4,973.58, while the Nasdaq composite was down 1.5 per cent points at 15,540.54.

The Canadian dollar traded down 0.20 per cent at 73.94 cents US compared with 74.16 cents US on Friday.

Advertisement 7

Article content

The April crude oil contract was down 0.42 per cent from Friday at US$78.86 per barrel, while the March natural gas contract was down less than a penny at US$1.61 per mmBTU.

The April gold contract was up 0.71 per cent from Friday at US$2,038.40 an ounce and the March copper contract was up a penny at US$3.85 a pound.

— The Canadian Press

11:41 a.m.

Ford cuts prices Mustang EV models

Ford Motor Co. cut the price of its electric Mustang Mach-E by as much as US$8,100 after its sales tumbled 51 per cent in January when the automaker had to stop offering tax incentives on the plug-in model.

The automaker lowered prices on multiple versions of the 2023 model Mach-E by a range of US$3,100 to US$8,100, according to an emailed statement Tuesday. The battery-powered crossover SUV that Ford makes in Mexico now starts at US$39,895, down from US$42,995. The biggest discount is offered on several versions, including the high-end premium model with an extended range battery, which now starts at US$45,895.

Amid an industry-wide slowdown in demand for electric vehicles, Ford’s EV sales fell 11 per cent in January. On Jan. 1, the Mach-E lost its eligibility for a US$3,750 US tax credit as the Biden administration tightened rules on stimulus measures to prevent EV makers from sourcing battery materials from China and other foreign adversaries. Ford also is cutting production of the Mach-E and the F-150 Lightning plug-in pickup truck.

Advertisement 8

Article content

“We are adjusting pricing for 2023 models as we continue to adapt to the market to achieve the optimal mix of sales growth and customer value,” Ford said in the statement.

— Bloomberg

10:25 a.m.

Stocks in U.S., Canada down to start shortened trading week

Stocks fell on Wall Street in morning trading on Tuesday to kick off a holiday-shortened week.

The S&P 500 slipped 0.6 per cent and is coming off only its second losing week in the last 16. The benchmark index is sitting below the record high it reached last week.

The Dow Jones industrial average fell 30 points, or 0.1 per cent. The Nasdaq composite fell 1.2 per cent.

Markets were closed in the United States on Monday for Presidents Day.

In Toronto, the S&P/TSX composite index was down 0.04 per cent after being closed on Monday for Family Day in Ontario.

— Bloomberg, Financial Post

8:30 a.m.

Inflation cools to 2.9% in January

Canada’s rate of inflation slowed to 2.9 per cent in January, down from 3.4 per cent in December, according to Statistics Canada’s monthly consumer price index data.

Statistics Canada said the headline deceleration was mainly due to a year-over-year decline in gasoline prices, which fell four per cent in January from 1.4 per cent the prior month.

Advertisement 9

Article content

Excluding gasoline, headline CPI slowed to 3.2 per cent in January, down from the 3.5 per cent growth in December, it said.

— Denise Paglinawan, Financial Post

7:15 a.m.

Stock markets before the opening bell

United States equity futures declined amid growing conviction that the U.S. Federal Reserve will hold interest rates higher for longer to curb a resilient economy — with some investors even starting to speculate that the next move may be up.

Futures on the S&P 500 and Nasdaq 100 were pointing to a down day when Wall Street reopens after Monday’s public holiday. Nvidia Corp. declined in pre-market trading ahead of its widely anticipated earnings report due Wednesday. Discover Financial Services surged after Capital One Financial Corp. agreed to buy the credit card issuer. Capital One dropped. The 10-year Treasury yield and the dollar were steady.

Traders have in recent weeks moved rate-cut expectation out to June, from March, as a phalanx of Federal Reserve officials warned against over-exuberant expectations of policy easing, and economic data continued to surprise to the upside. Former U.S. Treasury Secretary Lawrence Summers said on Friday “there’s a meaningful chance” the next move is up.

Advertisement 10

Article content

The S&P/TSX composite index closed up 0.16 per vent on Friday.

— Bloomberg

What to watch today

Innovation Minister François-Philippe Champagne will take part in discussions with players from the mining and critical minerals sector at an event in Rouyn-Noranda, Que.

Deputy Prime Minister Chrystia Freeland will deliver remarks and participate in a fireside conversation at the Association quebecoise de la production d’energie renouvelable 2024 symposium, in Quebec City.

Statistics Canada releases the consumer price index for January this morning.

Companies reporting earnings today include First Quantum Minerals Ltd., Walmart Inc., The Home Depot Inc. and Barclays PLC.

Recommended from Editorial

Need a refresher on Friday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content