Aaaaaaaaaaaaand we’re back! BTN Weekend hopes

everyone enjoyed the holiday last week. We took a little break to enjoy some fireworks and family time. This weekend, we’re visiting 1992, so here we go.

It was, simply put, a bonkers year for the corporate travel industry, but also a really important one for technology developments. We’re going to start with pricing, particularly in the airline space. In reading through the quite lengthy timelines for this year, however, you’ll see pricing experimentation clearly happening throughout the industry. Travel suppliers were still struggling with the effects of economic uncertainty lingering from two-plus years of recession and diminished travel volumes from the impact of Desert Storm.

Fuel costs mercifully declined toward the end of the year, and airlines were more than ready for that. Many domestic carriers in the U.S. still were not making money, though; across 10 airlines in the second quarter, carriers lost more than $600 million. As a result, pricing volatility and wild swings in rate structures across the entire 12 months were pretty much off the charts. BTN headlines in 1992 were a constant parade of will-they-or-won’t-they continue our corporate discounts, which at that time were regularly hitting anywhere from 35 percent to even 50 percent off of full fares.

In final quarter of 1991, which is the closest data I can get to 1992, the average full coach fare between Atlanta and Dallas, according to Topaz Enterprises a data firm that followed airline rates (acquired by Cornerstone in 2019), was $427. The average negotiated fare on that route was $236. That’s a 45 percent discount. Los Angeles to New York full coach was $735, but the average negotiated fare at that time was $371. That’s a full 50 percent off. So, obviously, these were different times, but critically important negotiations for corporate travel budgets.

To be fair, few people were buying rack rate airline tickets. Short term promotions were plentiful at the time, but regardless… locking in this type of discounting was a priority for a quality program.

The problem was that airlines clearly were not making margins given this level of discounting. In late 1991, as we left off in our last “episode,” there was already talk of airline discounts disappearing, and travel managers were getting really creative with savings strategies. Nearly a third, according to a BTN survey, were resorting to ‘hidden-city’ and ‘back-to-back’ ticketing to manufacture better pricing. Some buyers with deep international volume realized that carrier competition to capture business on lucrative transatlantic routes also gave them an edge for leveraging domestic discounts with certain carriers.

It was in this environment that Bob Crandall at American Airlines made a huge break with traditional pricing strategy. The carrier had dabbled in certain ‘no-frills’ routes earlier in 1992 to compete with Southwest, but then revolutionized its strategy in April with what American labelled ‘Value Pricing.’ It was a massive market share play to fill every seat on the aircraft.

A non-discounted Atlanta to Dallas coach fare dropped to $250, just $14

more than a negotiated fare. The fare between Los Angeles and New York?

$376—just a fiver more than the negotiated rate.

Long story short, it didn’t work. Crandall—and several other airlines that had followed suit—admitted the failure. Over the course of those months, however, corporates found their prized discounted meetings fares eliminated in the wake of value pricing and the effort to negotiate was, at least in the beginning, neutralized. Until the fare hikes started, and they came quickly. Corporates started to shift share to Continental and TWA, both carriers that were maintaining the traditional discount structure and soliciting hard to woo programs their way.

My favorite headline among all the discount talk in 1992 was from September 14: “Corp. America Is Mad as Hell” because they couldn’t figure out how airlines were trying to structure the deal.

Even those who hued close to traditional ways were more financially strapped than the experimenters. The discounts Continental and TWA were offering weren’t delivering the right revenue either. Continental got a cash infusion from an investor airline by September, but its debt position was bad. By the end of the year, three sales execs at TWA were canned on account of the liberal discounting.

I’ll let you peruse the highlight reel below on how hotels and car rental companies were faring. Advance purchase pricing at hotels, water tight meetings contracts held very little margin for group attrition or cancellation. Car rental firms were raising fares as well. Take a look, you’ll see it.

In the midst of all this pricing chaos, however, something else was happening… real, solid, exciting innovation.

It actually started in 1991 in Little Rock, Ark. when World Wide Travel introduced the ironically named, email-based “Quality Agent” technology that started the race to reduce the role of the agent in the travel booking process. By early 1992, several more companies were riffing on this idea.

In the same month that AA took pricing structures off the rails for corporates, Santa Barbara-based TravelNet launched its email-based travel reservation tool that tapped directly into a CRS. It was limited to companies that operated on the Macintosh—as it was called then (I owned my first one that year, coincidentally)—and the only company on the TravelNet tool at first was a Cupertino outfit called Apple supported on the agency side at the time by Maritz Travel Co.

In reading through these innovation articles, I love how we wrote about internet and computer-based messaging systems: ‘electronic mail’, E-mail… connected machines were “on-line.” Our language around technology and how we write about it has changed. BTN reporters were feeling their way around some new words and phrases.

Rosenbluth was the next agency with email-based itinerary requests. Amex Travel Management Services served up “electronic mail-based” reservations a few months later. “Agentless” became a word BTN reporters used a lot. But there were plenty of other innovations as well.

Topaz was delivering better data and reports; commissions settlement agencies were realizing they could provide more value with the data they had. Amex rolled out visual dashboards and claimed they had 25,000 separate visual graphic reports available. I’m wondering a little if that might have been a typo; could it have been 2,500? if you are in the know on that, email me.

I also loved the fact that World Wide Travel was getting feedback from clients that they didn’t have computer systems and email yet, so the agency obliged with a fax-based reservation process. I’m not sure how that worked without someone pulling the fax from the machine.

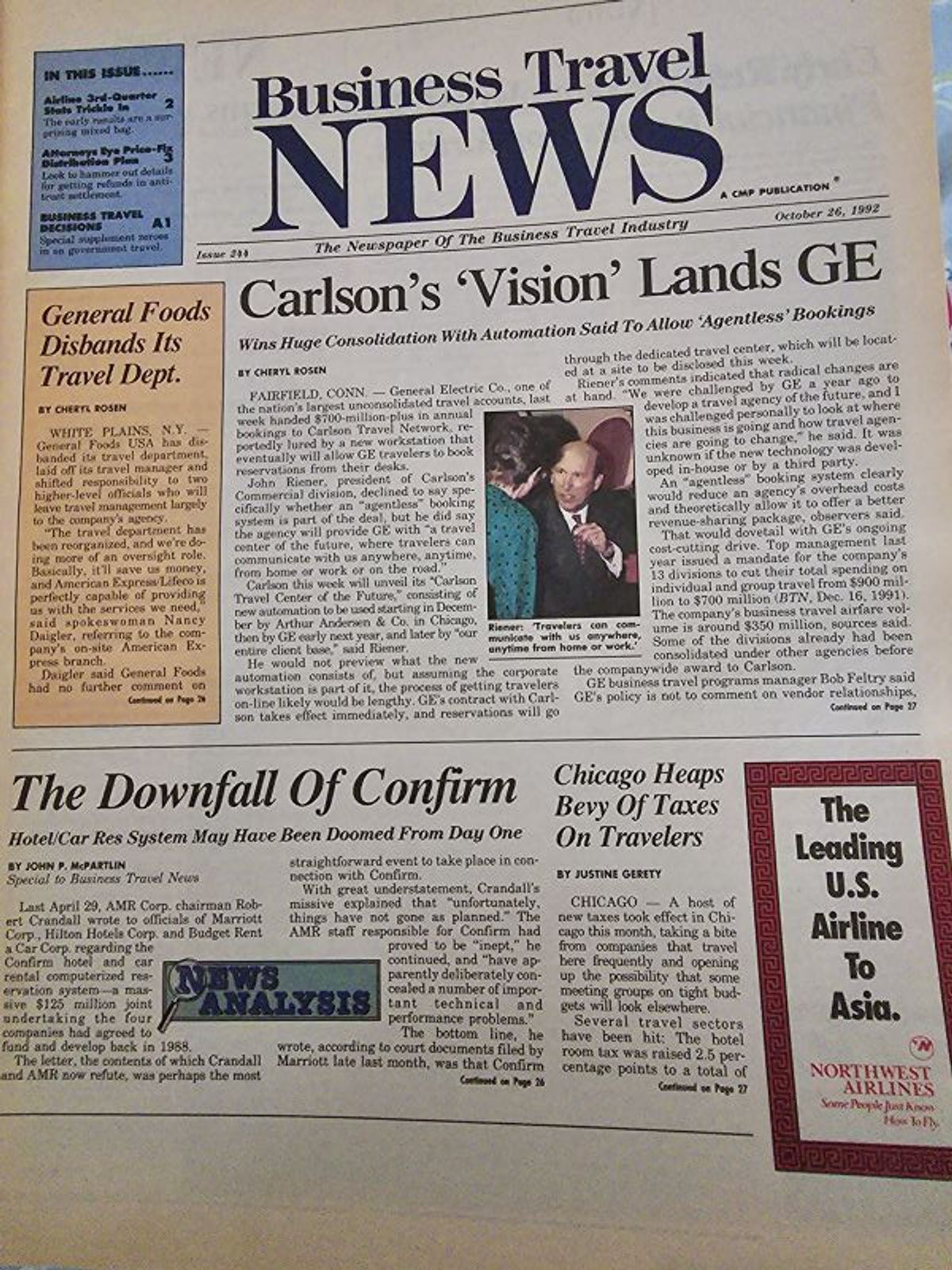

It looks like the Big Bang innovation came from Carlson Travel Network that year, which until its 1992 name change was known as Ask Mr. Foster. Carlson had leaned into the challenge of building the “Travel Center of the Future.” They had been challenged by GE to make it happen—a “fully automated” travel environment that would help the company cut its travel spend from $900 million to $700 million. It included a corporate “workstation” that required travelers themselves to be “on-line” and “agentless” booking was promised to reduce overhead.

But GE didn’t use it first. Accounting firm Arthur Anderson was the pilot company.

Take the wild ride through 1992!

_______________________________________________________________________

_______________________________________________________________________

Delta Air Lines begins business class service on New

York to Los Angeles routes, sparking a class-of-service competition on

cross-country domestic routes among Delta, American, United and Air

Canada. TWA, which already had domestic business routes, lowered its

fares.

Ziff Publishing with $11M in annual business travel

volume challenges prospective agencies to return an RFP option that does not

include a revenue share, but instead competes on service, including providing

metrics by which the service should be measured. Hello, KPIs.

Accounting firms Earnst & Young and Arthur

Anderson embark on travel program consolidation, the latest in a round of

mainly U.S.-originating travel consolidation at accounting firms, pushed by the

recessionary economic environment to rationalize their programs.

A new federal regulation under the Americans with

Disabilities Act goes into affect, stipulating that meetings must be

accessible to people with disabilities, including those challenged with

physical mobility, sight and hearing. Guidance, however, is late arriving,

impairing action.

‘Fare-checking’ software improvements roll out fast and

furious, as technology companies look to enable agencies to combat volatility.

Several new modules reduce ‘hits’ to the CRS—and associated costs—by using

information stored on local agency PCs.

USAir’s Randall Malin, architect of aggressive

pricing strategies that included eliminating non-refundable fares and

increasing commissions to agencies, is forced out as the carrier reports losses

of more than $1B in two years.

Rumors fly of an airline reaching out directly to

corporates, offering commissions on volume, instead of going through the agency

for commissions. Neither the agency nor the corporation is named, but

consultants speculate on a future where airlines stop paying agency

commissions.

Vince Wasik, the architect of National Car Rental’s

complex commission structure, is forced to resign. This follows the previous

month’s bitter exit of National’s top marketing executive.

American considers a ‘no-frills’ concept to compete

with Southwest Airlines, particularly on price-sensitive, short-haul

routes.

A survey of 200 corporate travel buyers from Fortune 100 companies

fielded by Budget Rent-a-Car returns an optimistic outlook even as economic

doldrums continue in the business travel market.

National Business Travel Association and the Association

of Corporate Travel Executives broach first talks of programatic tie ins. Some

see future partnership hinging on NBTA equalizing benefits for supplier and

buyer members. The conversation fizzles but will pick up a number of times

until, finally in 2020, ACTE shuts down and NBTA (now GBTA) buys ACTE’s assets

and folds in a former ACTE executive as CEO.

Falling meetings volumes see special fares retrenchment from

airlines along with restricted availability to meetings group bookings.

Hilton backs away from chainwide deals and pushes to

give discounts on properties where business place significant volume. The hotel

chain also centralizes commissions payments for a group of 50 hotels.

Covia and Galileo computerized reservation

systems merge

The Sheraton Los Angeles is likely the first hotel in

the U.S. to use guest check-in kiosks, allowing guests to check in with their

credit card details and without human interaction.

Hotel Clearing Corp launches as a commissions

settlement agency for 15 participating hotel chains. It also offers its client

agencies a second report that shows their customers’ hotel usage at those 15

chains. The report is available on paper or “on-line.”

Topaz data shows that indicates that airlines might

not be pulling back as much as they said they would on corporate discounting.

However, carriers seems to be striating into a tight upper tier of American,

Delta and United that discount conservatively, a second tier of Northwest and USAir with more moderate strategies and Continental and TWA with broader discounting opportunities.

American Airlines launches completely new air structure

that reduces the published cost of a full-coach fare by approximately 38

percent, with the rationale that less discounting would be needed to attract any

traveler—leisure or business. Observers warned that some corporations might see

their discounted fares eliminated and, therefore, their costs climb by 7 to 12

percent. Agencies are on the losing end of lower prices, which equal lower

commissions.

Santa Barbara-based software developer TravelNet rolls out an ‘electronic mail’ program that claims to streamline travel

bookings for companies with Macintosh computer networks. It also claims to provide

the side benefit of connecting the corporate directly to the airlines CRS. The

program translates ‘E-mail messages’ into CRS formats and vice versa. Consultants

claim they are beginning to see RFPs that seek a “fully automated booking

process.”

Sheraton begins to offer advance-reservation pricing;

boosts corporate discounts. The move appeals to small and midsize programs that

don’t have volume agreements. Hyatt would join the advance-purchase

trend in June.

With meetings business down and cancellations still high

after the Persian Gulf War in 1991, hotels tighten deposit and cancellation terms, add

meeting room fees and set up charges.

Amex Travel Related Services rolls out “graphic

reporting system” modeled on Executive Information Systems in what looks to be

the first travel reporting visual dashboard system.

Rosenbluth adds ‘E-mail’ for itinerary planning;

allows travelers to connect with agents through a new E-res system. The company

announces plans to launch an automated ‘E-mail booking system’ that will ‘skip

the agent’s involvement.’

Hertz and Alamo restructure pricing, add small

business rates aimed at corporations that don’t have a negotiated rate. Some are

reported lower than negotiated rates.

Confirm reservation system from Intrico, a

four-year-old joint venture between Hilton, Marriott, Budget, and AMR

Information Services (a subsidiary of American Airlines) that formed to

integrate hotel and car rental booking systems, acknowledged flaws in its

approach that would delay rollout by 18 months. By December, Confirm becomes

a cautionary technology development failure after 3.5 years and $125 million in

investment.

Continental inks deal with Amex Travel Related

Services that guarantees 5% to 7% discounts off lowest unrestricted fares—a

sweeping program, not tied to advanced purchase, that was also open to Lifeco,

with which Amex had merged months before.

Airlines’ new rate structure cancelled many meetings

contracts or made them unrenewable. As airlines extended other non-price

benefits to attempt to lure business back, Continental and Northwest actively continued to negotiate meeting discounts.

Ritz-Carlton Hotel Co. makes all rates from rack

rates to corporate negotiated rates to short-term promotional rates available

in the airline CRSs. This is a progressive move that includes 10 percent

commission for agencies on all rate types; plus additional commissions if they

are facilitating a meetings agreement.

Travel managers with international volume realize their

buying power with airlines—even when negotiating for domestic fares, which

airlines seem to be willing to use as something of a loss leader to get to the

more lucrative and fiercely competitive transatlantic volume.

Amex Travel Management Services regionalizes its

offices in the U.S. to be more responsive to clients. It brings travel and

corporate card services together under regional headquarters for clients, but

keeps management information services at the national level.

New car costs are on the rise and car rental firms Hertz and Avis acknowledge that contract clauses now allow them to increased rental

rates commensurate to OEM price hikes.

British Airways proposes to buy a 44 percent share in USAir for $750M. The deal had the potential to break the latter’s stagnating

position as a second-tier airline by expanding transatlantic routes. The deal

dies in December after Britain and the U.S. fail to agree on how

to reduce flight restrictions between the two countries, including activity through

London airports.

Employees of General Motors began testing Total

Travel Management software designed to facilitate travel bookings from a PC

integration into airline CRSs. Called Corporate Airline Reservations System it allows PC-based employees to tap into Total Travel’s proprietary database

containing preferred vendor rates for corporates.

Q2 losses among nine U.S. airlines add up to $500M. The red

ink “bore the imprint of AA’s April price restructure,” according to BTN.

Industry fears more cost cutting and service erosion. AA (and other

airlines) eye wide fare hikes for September to recoup losses, but then seem to

pull back on the hikes in the eleventh hour.

Little Rock-based World Wide Travel Service Inc. releases

a system that automatically makes an airline reservation in response to a fax. It

comes two years after a similar technology that reserves air in response to an ‘E-mail’

message. It is targeted to companies that have not yet embraced email.

Hotels implement one-stop shopping with national sales

offices representing not just the chain but also individual agreements at specific

hotels within the chain.

Amex introduces an email-based booking product. “It’s

not the first electronic-mail product in the travel business,” the BTN article reads, “but it’s almost certainly bound to have the most users.”

They’re still called CRSs, but they are starting to try to

integrate with one another “knowing they can’t be all things to all people.”

They also are encouraging more ways for third-party technologies to integrate

with them to generate more innovative products and services.

Air Canada makes a bid to buy Continental for

$400M, seeking to build fourth North American mega-carrier with the help of its

fresh United marketing accord and with the hopes of also acquiring Canadian

Airlines International. The bid ultimately increases to $450M and relieves Continental’s bankruptcy issues. The CAI element of the pact dies.

Modeling the eventually ill-fated agreement between BA and USAir, KLM and Northwest Airlines agreed a marketing and schedule

alignment that resulted in the two airlines operating as one airline with joint

pricing and strategy.

American Airlines waves white flag on ‘value pricing’

structure. “We have abandoned it,’ said then-chairman Robert Crandall. “It didn’t

work.” Instead, he said, American would begin to file “every cockamamie

fare anybody else wants to file,” a move that completely upturned the “simplicity”

strategy from five months prior.

DOT calls for looser contract terms and more freedom

for third-party software and equipment firms to access CRSs. The new rules

clear the way for developers to innovate with workstations “that could access

the CRSs to compare information and make bookings as well as integrate with

each other.”

Budget Rent a Car separates corporate sales team from

agency sales team.

Continental eliminates first-class service cabin but

upgrades business class with a selection of first-class amenities and renames

it BusinessFirst.

Mega-agency Carlson Travel Network lands General

Electric as a consolidated $700M client thanks to an automated “travel

center of the future.” It includes “agentless” bookings.

Covia Partnership launches email-based agentless

travel booking system, using ApolloMail form to request a trip.

Car rental companies move again toward rate hikes in increasingly

price sensitive market, and the look to reinstate mileage caps.

TWA fires three key sales execs responsible for the

liberal discounting consistently extended to corporates.

American Airlines caves to a number of associations

on extending meeting fares; a strategy it had been avoiding for several months.

Later that month, several airlines agree that their zone fare strategies that

once were reserved for incentive programs only had been extended to both

association and corporate meetings. It’s the first acknowledgement since the April

fare restructure that there was still a special fare for meetings.

Amex Travel Management Services after just one year drops

its expense reimbursement plan under which clients turn over the T&E

process to the agency. “At this point we are rethinking the system,” said execs.

John Reiner, president of Carlson Travel Network’s

commercial division and architect of “the Travel Agency of the Future”,

leaves the company.

Airfares end the year climbing.

_______________________________________________________________________

Elizabeth West is the editorial director of the

BTN Group. She has reported on the business travel and meetings industries for

24 years. Beth was editor-in-chief of Meeting News from 2006 to 2008 and

director of content solutions for ProMedia Travel from 2008 to 2011, when

ProMedia was acquired by Northstar Travel Media and merged with BTN. She became

editor-in-chief of BTN in 2015 and editorial director of the BTN Group in

2019.

_______________________________________________________________________